Budgeting used to involve a paper, pen and hours of work hunched over receipts and bank statements, but those days are long gone. Thanks to modern spreadsheet programs, you can make a do-it-yourself budget in just a few minutes. Whether you are new to personal finance management or a long-time veteran looking to improve your budget, follow along to create a personal budget spreadsheet to help you conquer your spending once and for all.

Step 1: Start with your income

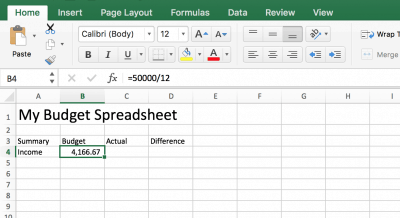

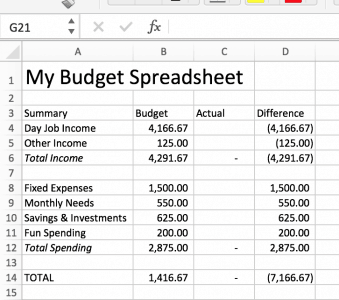

When setting up a budget spreadsheet, it is best to start with your income. You can’t spend more than you earn, so use this as a starting place when creating your spreadsheet. You can format your spreadsheet any way you’d like, but for this guide I am going to put it together in Microsoft Excel. Google Sheets is an awesome, free alternative.

For the example, I am assuming a $50,000 annual income. In cell B4, I used the formula “=50000/12” to get a monthly income budget. If you have a side hustle, you can include that in your total income or another income line. For this example, I am treating this number as an after-tax income number. Look at your pay stubs to see what you take home each month and use that number for a better estimate of your income.

A budget is a good way to control your expenses, but remember that real wealth comes from a higher income, so don’t discount the importance of this line in your budgeting spreadsheet.

Step 2: List monthly recurring expenses

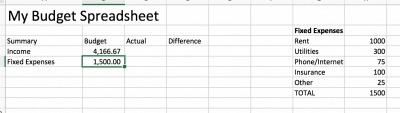

On the next line of your budget spreadsheet, make a space for your recurring, fixed expenses. Include mortgage or rent, utilities, phone and internet bills, insurance and other recurring expenses you can’t live without. For the sake of this exercise, consider your cellphone a necessity, even though you really could live without it, but exclude entertainment subscriptions, such as Netflix.

You can create a section on the right of the same tab or on a new tab just for expenses depending on your comfort level using your spreadsheet program. I used the SUM function to add up the expenses and a formula to link the total $1,500 budget to the total of fixed expenses.

I used example numbers here, but you can look up your average expenses for these categories on your recent bank or credit card statements.

Step 3: Budget for monthly needs

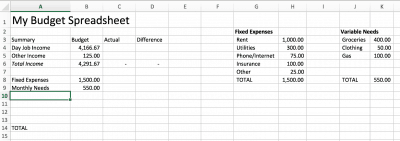

Continuing on to the next section, it’s time to add other monthly needs that you can’t live without, but have a less predictable dollar amount. Groceries, clothing and gas are common in this section of your budget.

Remember that there is no right or wrong answer with a budget, just what is right for you. Don’t judge your budget harshly based on these estimated numbers, and adjust the categories as needed to match your average spending.

Step 4: Add in savings and investments

There is a common saying in personal finance: pay yourself first. That is where we are going to look next on your budget. Remember to put money away for an emergency fund, savings, retirement and investments.

Sometimes these deductions are made by your employer before your paycheck arrives. If that’s the case for you, list those deductions separately on your spreadsheet, but do not include them in your budget, as it is money you don’t really have to spend each month.

To retire comfortably and maintain the same quality of living in retirement, you should save around 10%-15% of your pay each month. That might seem like a lot, but it would be much worse to end up retiring in poverty.

Step 5: Factor in fun spending

Some people budget to very detailed categories. If you want to do so, that is not a bad idea. However, it’s not necessary. You can budget using high-level categories that catch all of your spending for a simpler budget process. That’s what we are going to do here.

Add a line in your budget sheet for fun spending that includes entertainment, shopping, restaurants and anything else that isn’t a need. A lot of people have trouble deciding what is really a want and what is really a need. Be conservative here and put things as a want when in doubt. The only real needs are a home, food, clothing, transportation to work, insurance and taxes. I know you think you can’t live without that cute Prada backpack or Xbox One, but I promise those are actually wants, not needs.

Step 6: Add it up and calculate your budget

Now you have enough information to add up your budget and look for areas to make adjustments.

As you can see, I broke down the budget spreadsheet into a section for income and a section for spending, with a total at the bottom of each section. I added a column for your personal budget and a space for you to input your actual results each month. Some spreadsheets are built to be used throughout this year. This simple version is intended to be copied and reused each month.

I also created a “difference column” that calculates how you did compared to your budget. The formulas are opposite for the income and expense sections, as going over in income is a good thing but going over in expenses is a bad thing.

At the bottom, you can find your total. In this example, we have $1,400 left over each month for savings and carryover to future months. Some people would add a carryover line to their budget to import from the prior month; others prefer to start fresh each month.

What is important is to pick a method you will actually use. A budget is worthless if you don’t really use it!

Step 7: Update your budget spreadsheet to stay on track

Your income and expenses change over time, and your budget should too. As new expenses appear and go away, and your income (hopefully) grows over time, update your budgeting spreadsheet to ensure it is accurate and works for your needs. If you do, you’ll be on track for long-term financial success for years to come!

More articles from Living on the Cheap:

Clothe the kids without busting the budget

Change bad spending habits and save money

How to get your financial life in order