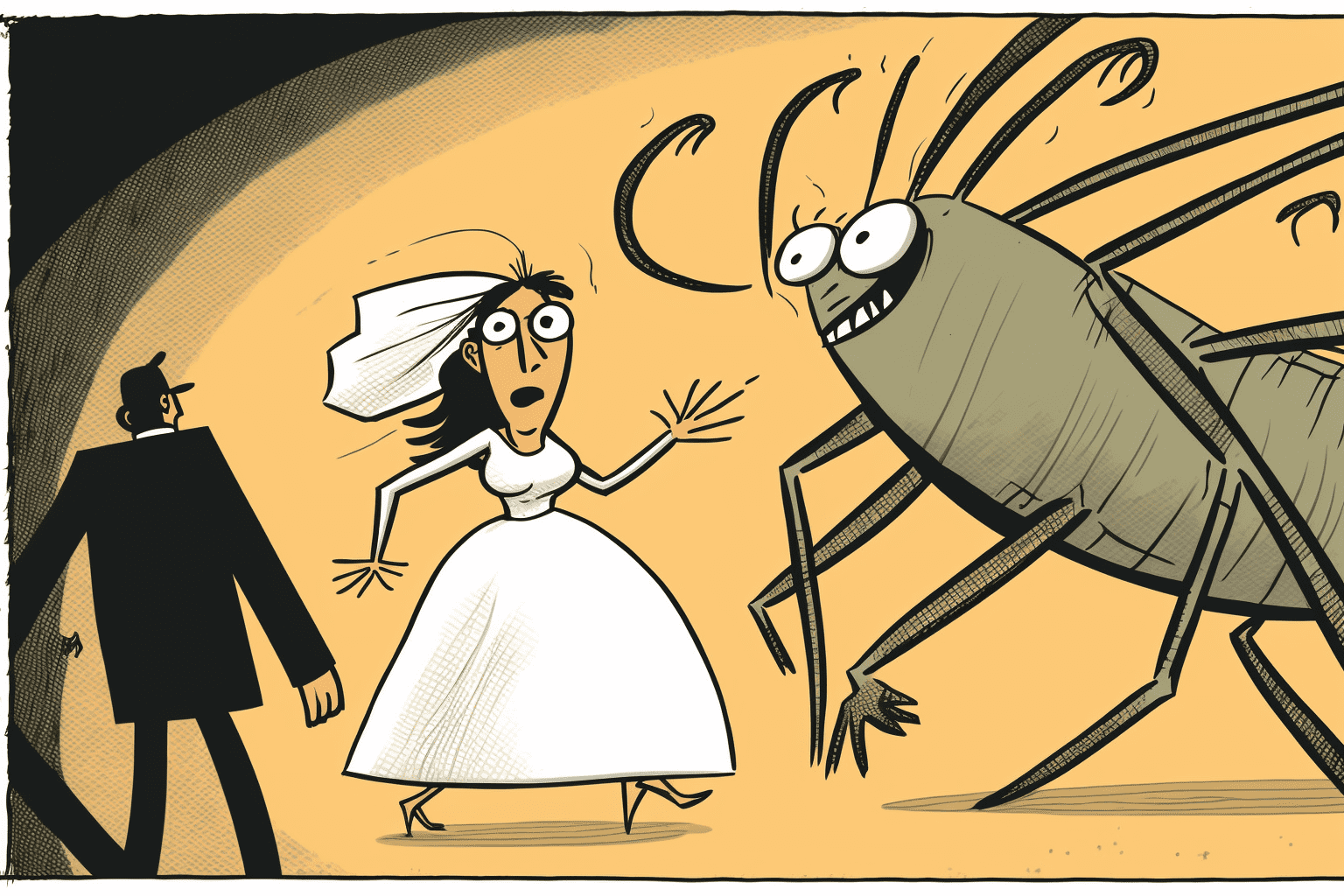

Lisamarie Monaco was staying at a resort hotel in Fort Lauderdale, Fla., and things were not going as planned. That’s putting it politely.

Her room had no working power outlets, so she couldn’t recharge her phone or use her hair dryer. Enormous palmetto bugs lived under her bed, scurrying into the open after she doused the lights.

Oh, and it was the night before her wedding.

“I went to the front desk and complained,” recalls Monaco, an insurance agent from Jacksonville, Fla. “I didn’t want to sound like a crazed woman — but it was my wedding.”

Illustration: Christopher Elliott

Here’s how the bride got a do-over

Monaco’s experience is instructive. After she complained, the hotel immediately moved her to an upgraded, insect-free room.

“After the ceremony, the hotel invited me back for two free nights for a do-over anytime,” she says. “And they also apologized.”

Monaco believes her strategy was the key to getting a do-over. She remained calm and never demanded a free room. The hotel quickly offered it to her because it’s the right thing to do when you put a bride in a bug-infested room the night before her wedding.

About 5% of the cases I receive at my consumer advocacy organization directly ask for a do-over of some kind as compensation for a trip gone wrong. But most fail.

Why most do-over requests fail

I’ve always wondered what sinks a do-over request. So I asked Tom Peyton, vice president of Kids Sea Camp and Family Dive Adventures, to help me understand.

He says vacations are rarely an entirely negative experience. For example, one of his clients might miss a dive on a trip, but the rest of the tour will go off without a hitch. And while a customer may think this “ruins” the entire trip, the truth is, it’s only a small part of the experience.

“We’ve credited a partial trip or a discount on a trip due because of an illness or an accident,” he says. He’s never invited a client to return for an all-expenses-paid vacation.

Sometimes, travelers ask for a do-over and compensation for an inconvenience. That all but dooms the request.

A few months ago, one reader asked to return and redo his cruise because the ship skipped one port of call. He also demanded an onboard credit to make up for the trouble. The cruise line quickly turned him down.

How to get a do-over from a travel company

You can increase your chances of a do-over with a few simple strategies.

First, make sure you have a compelling case. If you can imagine it as an example in this story, you’re good. Avoid presenting the company with a laundry list of grievances; instead, choose one or two problems and focus on it. (Bugs on your wedding night — you can already see the headline!)

Then, make sure you ask the right people. Starting with the customer service department or the hotel’s front desk is the best idea, according to Jeff Galak, an associate professor of marketing at Carnegie Mellon University’s Tepper School of Business. “Companies don’t want their customers to have bad experiences, but when that does happen, they have an incentive to fix those problems,” he adds.

If those people tell you to get lost, appeal to their supervisors. You can ask for a manager or look up a supervisor on this list of executive company contacts on my consumer advocacy site, Elliott.org.

And always be patient, persistent and polite.

Travel insurance can give you a do-over, sort of

Your travel company may not offer a vacation do-over, but your travel insurance company might.

“While travel insurance can’t help if you if you have a bad time on your trip, it may provide some relief if you got sick or injured while traveling and had to cut your trip short,” says Terra Baykal, a senior marketing manager at World Nomads.

For example, trip interruption coverage could reimburse you for prepaid nonrefundable trip costs like accommodation, tours and cruises.

But what if you don’t like your vacation? There’s a limited do-over option, too.

Trawick International recently launched an insurance product called “interrupt for any reason.” It’s an optional benefit that allows you to leave your vacation for any reason and seek reimbursement of up to 50 percent of your trip cost for your lost days and additional transportation cost to return home.

“For example, if you take the family to Hawaii but get there and it rains every day, you can’t enjoy all your anticipated beach activities and may choose to cut your losses and head home,” explains Bailey Foster, vice president of trip insurance at Trawick. “Travel suppliers would not provide you with a refund. But with interrupt for any reason, you can get back some of your expenses and put them towards a redo for your future trip.”

Why we need more do-overs

Do-overs may be expensive to a company, but they are even more expensive when companies don’t do them.

Mario Matulich, president of Customer Management Practice, sums it up best. Forward-looking companies “understand that it’s worthwhile to take a minor hit to their bottom line to make things right after a bad experience,” he says.

Telling customers that “rules are rules” often leaves them feeling betrayed and deeply disappointed. They promise never to fly that airline, stay at that resort, rent from that car rental company — and they tell all of their friends. Then they make a viral TikTok about the incident.

It’s simple economics. A comped hotel room costs far less than the long-term loss of business.

Also, it’s often the right thing to do.

Christopher Elliott is an author, consumer advocate, and journalist. He founded Elliott Advocacy, a nonprofit organization that helps solve consumer problems. He publishes Elliott Confidential, a travel newsletter, and the Elliott Report, a news site about customer service. If you need help with a consumer problem, you can reach him here or email him at chris@elliott.org.